What you need to know about marriage contracts

Understanding how a marriage contract works can prevent legal battles and protect your assets, should your marriage not work out in the future.

A marriage contract determines how your property will be divided in the cases of death or divorce. However, your last will and testament, which deals with the division of assets after death, may determine how your assets are divided if your marriage contract is not drawn up properly.

Understanding the different marriage contracts

There are 2 marriage contracts: community of property or an antenuptial agreement. If you choose to be married in community of property, your assets are shared equally. If you don't want your assets to be shared, you need to sign an antenuptial agreement before you get married. If you don't sign an antenuptial agreement, you’ll automatically be married in community of property.

Marriage in community of property

This agreement combines everything that you and your partner owned before and during your marriage. This excludes any items you’ve inherited.

While it creates a sense of partnership, it can become problematic because you'll to get written permission to buy or sell property including jewellery.

Pros:

- If you get a divorce, you'll get half of your shared assets.

- You’ll manage your assets together instead of doing so individually.

Cons:

- To enter into any credit agreement you’ll need written permission from your spouse.

- All the debt you had before and during marriage becomes part of your joint estate. This means that you’re responsible for your partner’s debt.

Marriage out of community of property (antenuptial)

This contract provides 2 options, marriage with or without the accrual system.

A marriage with the accrual system protects the partner who is financially vulnerable while the marriage without the accrual system allows each partner to freely manage their own assets.

1. Marriage out of community of property with accrual

If you choose to be a stay at home parent or offer up your studies, this system ensures that you’re covered.

Pros:

- You’re not responsible for your partner’s debt.

- You’re allowed to manage and grow your assets without your partner’s permission.

- The assets you owned before your marriage are protected and won't be included in your marriage contract.

Cons:

- If you’re the financially stronger partner, you’re required to share the assets which you acquired during your marriage with your partner.

- If your partner is the breadwinner, you’ll be financially dependent on them.

2. Marriage out of community of property without accrual

This contract separates your assets from your partner’s. In the case of divorce, it ensures that you retain the assets which you’ve gained before and during your marriage.

Pros:

Pros:- You control your assets independently.

- You don’t need consent from your spouse to enter into any agreements.

- Your partner cannot claim any of your assets at the end of your marriage.

- If you give up your career or, choose to stay at home to care for your children, this system won't benefit you because your partner is required to share their assets with you.

What’s next?

Determine which marriage contract suits you best, and get help from Families South Africa (FAMSA).

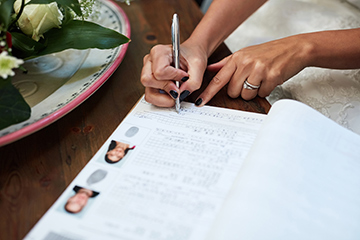

Marriage certificates

When you get married, you’ll be issued with a handwritten marriage certificate (BI-27) at no cost. For your convenience, it's best to apply for your unabridged marriage certificate from the Department of Home Affairs as soon as possible thereafter.

- Getting Married? Here’s What You Need to Know (Public Information)