Financing your business

A financial feasibility study identifies how much start-up capital is needed, sources of capital, returns on investment, and other financial considerations. It looks at how much finance will be needed, where it will come from, and how it will be spent.

A financial feasibility study will help you to determine:

- whether the business will show a profit;

- how much money you will need to invest in the business;

- how much money you will need to borrow;

- what the operating or running costs will be;

- how much you must sell to cover your costs;

- what the cash flow will be, and whether the expected profit is worth your while given the risks involved.

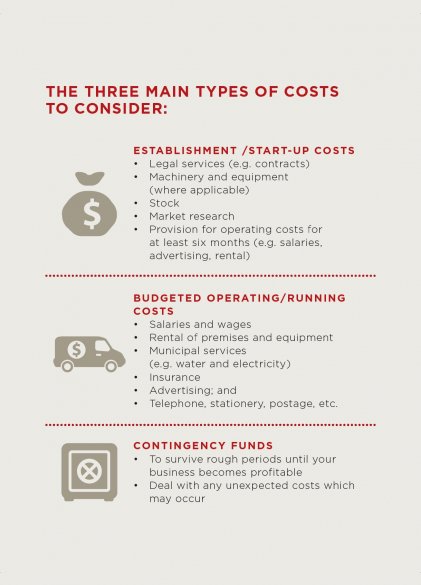

The three main types of costs you need to consider are the following:

1. Establishment /Start-up costs

- Legal services (e.g. contracts)

- Machinery and equipment (where applicable)

- Stock

- Market research

- Provision for operating costs for at least six months (e.g. salaries,

advertising, rental)

2. Budgeted operating/running costs

- Salaries and wages;

- Rental of premises and equipment;

- Municipal services (e.g. water and electricity)

- Insurance;

- Advertising; and

- Telephone, stationery, postage, etc.

3. Contingency funds

- To survive rough periods until your business becomes profitable

- Deal with any unexpected costs which may occur

Carefully evaluate your business idea. Having a thorough understanding of its strengths and limitations will help define your financial requirements and identify your most likely sources of funding.